Honesty is the Best Policy.

Life, income, health insurance, made simple.

Insurance in 3 simple steps

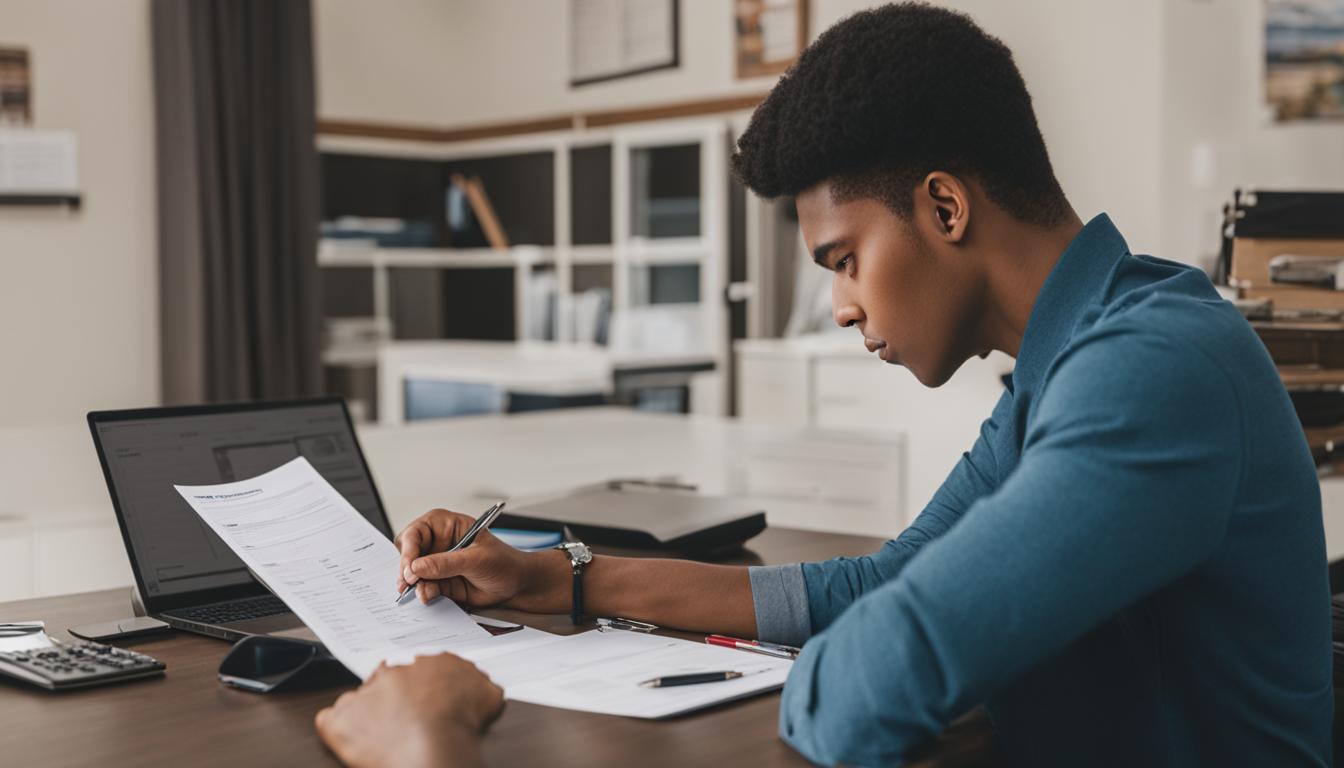

Enter Your Information

Provide us with your necessary details to ensure tailored coverage. Navigate our simple form and give pertinent information. For a bespoke plan, it’s crucial to understand your unique needs.

Compare Quotes

Review various offers and choose the best. We present you with a range of options, each catering to different needs. Always consider both coverage and cost when making a decision.

Speak to an expert advisor

Chat with our knowledgeable consultants. Remember, we’re here to help, ensuring you make the most informed choice for your security.

WANT TO GET INSURED?

Get a quote now!

Secure your health and wellbeing with Pure Cover’s Critical Illness Cover. It’s more than insurance, it’s your safety net. Make the smart move, act today.

Articles & Guides

Dive into Pure Cover’s enlightening articles and guides, your trusted source for clarity on all things health insurance.

17/04/25

Food Blogger’s Guide to Life Insurance: Protecting Your Passion and Your Future

Read more

5/03/24

Understanding Life Insurance: A Comprehensive Guide to Different Types

Read more

5/03/24

Whole Life Insurance Explained for UK Residents

Read more

4/03/24

Joint Life Insurance Policies: Understanding the UK Market

Read more

3/03/24

Understanding Term Life Insurance in the UK

Read more

3/03/24

Decreasing Term Life Insurance: Is It Right for You?

Read more

2/03/24

Group Life Insurance Schemes in the UK Workplace

Read more

2/03/24

Renewable Term Life Insurance in the UK: A Guide

Read more

29/02/24

Life Insurance for High-Risk Occupations in the UK

Read more

28/02/24

Understanding Limited Pay Life Insurance in the UK

Read more

28/02/24

Life Insurance for Smokers in the UK: What You Need to Know

Read more

27/02/24

Survivorship Life Insurance: A UK Couple’s Guide

Read more

26/02/24

Life Insurance for Young Adults in the UK: Starting Early

Read more

26/02/24

Retiree Life Insurance: Secure Your Future with Comprehensive Coverage

Read more

25/02/24

Millennial Life Insurance: Protect Your Future with Affordable Coverage

Read more

24/02/24

Newlywed Life Insurance: Protecting Your Future Together

Read more